India imposes windfall tax on refiners and crude producers

Impact on stocks like MRPL, Chennai Petroleum & Reliance Industries

India is Asia’s leading exporter of petrol and diesel. Yet, in the first half of June, diesel imports reached the highest level since February 2020 and petrol imports reached a 7 month high. The Private retailers were also cutting down on sales at their pumps as the prices have not been revised by the public retailers like HPCL, BPCL and IOCL of late making it quite unsustainable for the private retailers. A simple revision of price hike at private retailers would anyways divert all the demand to the public refiners’ pumps.

The Indian government on 1st July 2022, imposed a special excise duty of ₹6 per litre on exports of petrol and aviation turbine fuel (ATF) and ₹13 per litre on exports of diesel. Looks like this step is to shore up Government finances as well as preempting any shortages at the pumps locally.

Assuming,

1 Barrel = 159 Liter

1$ = Rs 78

3-2-1 crack spread (3 parts crude refined to produce 2 parts petrol and 1 part diesel

So Rs 13 /L on diesel and Rs 6/L on petrol and ATF, duty in terms of GRM comes to (13+6+6)/3 = Rs 8.33/L = $ (8.33/78)*159 per barrel = $17 /B

The above impact is if 100% of produce is Diesel, Petrol, ATF and 100% of it is exported. The impact depends on the produce mix as well as export component.

This move by the government impacts Reliance Industries among the refiners as the remaining ones like HPCL, BPCL and IOCL do not export. Among standalone refiners, Chennai petroleum has near to zero exports as they sell almost all of their produce to their parent IOCL. MRPL in FY20 exported about 20% of their diesel and petrol produce, which came down to around 10% in FY21, mainly due to freight constraints. Data for FY22 is awaited as the annual report is yet to be published. Considering MRPL does not only produce diesel, petrol and ATF, the overall impacted volume for would be less than 10% of its capacity.

72% of Reliance’s produce is diesel + petrol + ATF and around 58% of that is exported.

Company wise impact:

Reliance: $17 * 0.72 * 0.58 = $7/B. Reliance takes a hit of $7/B on its GRM

Ball Park figures by analysts is a $400 M impact on EBITDA per $1 change in GRM, so the total impact would be $2.1B (3/4 of $2.8B as it applicable for the last 3 quarters this fiscal).

Reliance lost $19B or about 9 times impact on EBITDA, typically valued at 6 times EV/EBITDA. So one may argue the sell off was overdone, but how does one value the hit on sentiment?

What about the impact on other refiners?

MRPL: $17 * 1 = $1.7/B. MRPL takes a hit of about $1.7/B on its GRM. Do note they can bring the impact down to zero if they stop exporting and sell all their fuel produce to its parent company HPCL, just like what Chennai petroleum does.

HPCL: Zero impact

BPCL: Zero impact

IOCL: Zero impact

Reason the above stocks ended in green on Friday, with HPCL up more than 5%. This move by the government makes more of petrol and diesel to be available locally which is also positive as recently the public refiners have had to increase the costly imports.

My reading is that Chennai Petroleum also has zero impact, though its stock price fell 5%.

Additionally the government has levied a cess of ₹23,250 per tonne on domestically produced crude oil. This impacts producers like ONGC, OIL India and Vedanta who have > 2M Barrel crude production capacity. This comes to $40/B. As Prashant Nair from CNBC18 mentioned, Market was anyways pricing ONGC & Oil India at $50/B crude. This may remove the uncertainty, and with $40 cess, markets are now pricing them at $90 crude. The India basket may be closer $100 currently, maybe lower due to the increasing share of imports from Russia. Oil India fell 15%, ONGC fell 13% while Vedanta was down 4%.

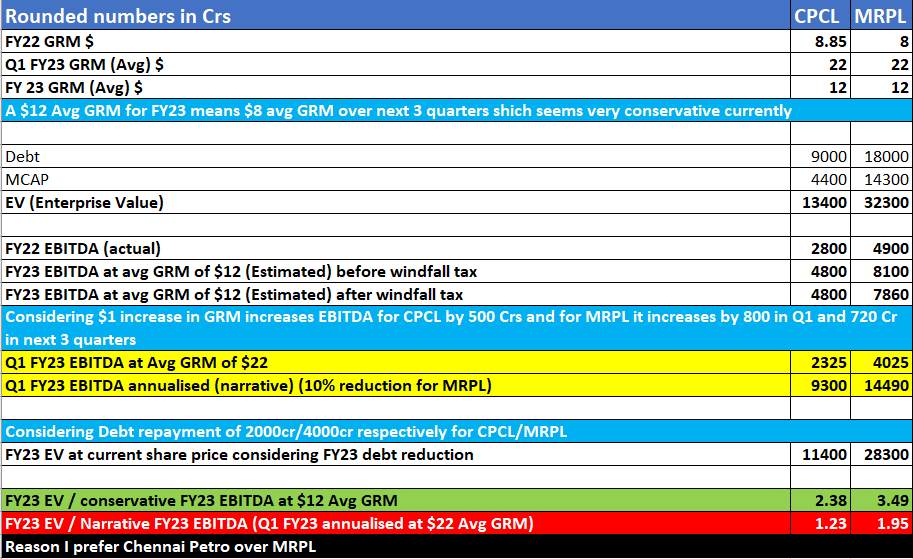

Having digested the news, I am constructive on the stand alone refiners, as other public refiners are hit by the loss on marketing margins as they are not revising fuel prices for some time now despite the strength in Crude prices. It difficult to calculate the positive impact of increased import of relative cheaper Russian crude, so leaving that aside, here is my ball park EBITDA calculations for MRPL and Chennai Petroleum, the latter being my preferred pick.

The sentiment has soured, but there still seems to be value as the calculation above is based on an average GRM of $8/B for the rest of the 3 quarters this Fiscal, Q1 GRM being $22/B. I have tweeted and shared resources on why the refining margins globally may remain higher for longer, mainly due to decreasing refining capacities globally over the past few years. The demand impact due to upcoming recession is also something to watch out for. Investors have to keep close track of the refining margin trends if they are looking to invest in these stand alone refiners.

I keep providing 360 degree updates on the stocks I cover on twitter @stocks_populi.

Do leave your comments and thanks for reading!

correct me if i'm wrong sir.

but at Rs. 23,250 per tonne, it's probably Rs. 23.25 per litre ...

Rs. 3,696.75 for 159 litres (a barrel)...

$47.39 per barrel (using 78 Rupees = 1 USD)

?

Excellent article. Thanks